Summit Business Advisors Llc Fundamentals Explained

Table of ContentsOur Summit Business Advisors Llc Statements7 Simple Techniques For Summit Business Advisors LlcSome Known Details About Summit Business Advisors Llc The Basic Principles Of Summit Business Advisors Llc Summit Business Advisors Llc - Truths

They can be fee-based, commission-based, or a mix of both, depending on the company needs and arrangement. Monetary advisors can gain as much as they can as long as they have the interest, power, and capability to obtain even more clients.

Financial Planning is a crucial aspect in today's world of inflation every one desires to keep a healthy and balanced situation of wide range in his life. With regular revenues, one can preserve the household costs & various other requirements. Yet there are some other costs likewise which require to be satisfied out of the very same earning itself.

How all this can be done? A little inquiry occurs psychological of every employed person due to the fact that these all need to be intended with the current earning which can fulfill all the requirements. Financial planning describes the procedure of improving the income, expenditures, possessions & responsibilities of a household to care for both current & future needs for the funds.

Rumored Buzz on Summit Business Advisors Llc

As we understand everybody having a different method towards life, so an expert requires to prepare all the factors & suggest them the tools as necessary. A consultant is a person that understands the value of all monetary items on one hand & the demands of the customer on the other side.

As many accuracies of possession courses are readily available an individual requires to comprehend them initially as per the future goal. Estimating economic. Los Angeles Bookkeeping goals, finding appropriate items, and reaching appropriate allocations to different assets need specific knowledge and abilities which may not be readily available in many houses. Possession allocation is a huge approach one ought to initially understand the demands and needs of the client then intend to handle it as per the demand of the customer.

They are registered with either the Securities and Exchange Payment or state safeties regulators. 1 Many independent advisory companies are possessed by the private consultants that run them, so they create deep, individual relationships and have a strong feeling of accountability to their customers. As one of the fastest-growing locations within the economic solutions sector, independent experts have actually raised their properties taken care of by even more than 14% year over year given that 2008, and this number is anticipated to expand another $1 trillion in the following 2 years (2015-2016) alone.

The Ultimate Guide To Summit Business Advisors Llc

Therefore, lots of independent experts concentrate on structure deep partnerships with their customers. This usually takes regular, recurring communications. And because a number of these experts are entrepreneurial local business owner, they hold themselves directly answerable to their customers. Independent advisors usually bill a fee based upon a percentage of assets handled.

Others can help you with detailed services, such as estate preparation or loaning, the sale of an organization, difficult tax obligation situations, trusts, and intergenerational wide range transfer. Independent experts utilize independent custodians, such as Charles Schwab and others, to hold and secure clients' possessions (Los Angeles Bookkeeping). For several financiers, this gives an encouraging system of checks and balances your cash is not held by the same person who suggests you about how to spend it

As the graph below shows, they are most thinking about getting help preparing for retirement and handling investments. We likewise asked if customers look for consultants who can examine financial investments and make profile referrals, or are largely interested in a consultant who creates a strategy to fulfill numerous economic objectives.

Plainly, clients care about ESG. They likewise care about their advisors' individual worths 53.8% said an advisor's individual worths influence their choice to do organization with the economic consultant.

Our searchings for recommend that most clients favor an equilibrium of online and in-person solutions. When we asked our respondents, "What is your preferred form of contact with a monetary expert?" we found that: 52.3% choose an initial in-person conference complied with by subsequent Zoom or telephone conferences 38.9% like in-person just In terms of conference frequency, a plurality of participants felt that every 6 months was the wonderful spot although some disagreed.

Some Of Summit Business Advisors Llc

Saving for retired life in specified contribution plans has actually created a solid need for understanding of retired life income preparation. Capitalists want their advisor to consider their ESG preferences when (https://www.pubpub.org/user/paul-crabtree) developing an investment approach. Extra customers choose to go to regular conferences with their advisor either via Zoom or a telephone call, but a strong bulk still prefers to be physically existing for initial meetings with an expert.

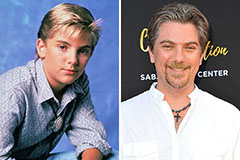

Angus T. Jones Then & Now!

Angus T. Jones Then & Now! Kirk Cameron Then & Now!

Kirk Cameron Then & Now! Jeremy Miller Then & Now!

Jeremy Miller Then & Now! Barry Watson Then & Now!

Barry Watson Then & Now! Jaclyn Smith Then & Now!

Jaclyn Smith Then & Now!